6 Things I Wish I'd Known About Personal Income Tax Software Before I Invested in One

While the advent of personal income tax software has democratized the realm of taxation, navigating the labyrinthine intricacies of this domain still poses significant challenges. In retrospect, I have identified six fundamental insights that would have been invaluable prior to my first foray into this sphere.

-

The Spectrum of Complexity

Income tax software ranges from the elementary to the exceedingly complex. At one end of the spectrum, programs like TurboTax and H&R Block cater to laypersons with straightforward income tax situations. They utilize a question-and-answer interface and have robust error-checking mechanisms, making them ideal for W-2 employees with no additional income sources.

However, as one progresses up the complexity gradient, the income sources and tax situations diversify, and correspondingly, the software becomes more sophisticated. Solutions like TaxAct and TaxSlayer, for instance, are equipped to handle intricate scenarios such as rental income, capital gains, and foreign-sourced income.

-

The Cost-Benefit Analysis

The Red Queen hypothesis, an evolutionary theory, is surprisingly relevant in this context. It posits that organisms must constantly adapt and evolve merely to maintain their current status quo in the face of a changing environment. Similarly, the cost of tax software is not a standalone investment but needs to be assessed relative to the time and effort it saves, the potential for reducing tax liability, and the assurance of compliance with tax laws.

-

The Overlooked Importance of Customer Support

In 1992, Robert Kaplan and David Norton introduced the Balanced Scorecard, a strategic planning tool that highlights the importance of viewing organizations from various perspectives. Applying this tool to evaluate tax software solutions, the customer perspective reveals the critical role of customer support. Comprehensive support through live chat, phone, and email is a significant factor, especially when dealing with complex tax scenarios or last-minute queries.

-

The Security Imperative

Given the sensitive nature of tax-related information, data security is paramount. Encryption algorithms, such as the Advanced Encryption Standard (AES), employed by tax software companies, play a critical role in safeguarding user data. AES, in particular, is a specification established by the U.S. National Institute of Standards and Technology and is widely recognized as uncrackable.

-

The Power of Machine Learning

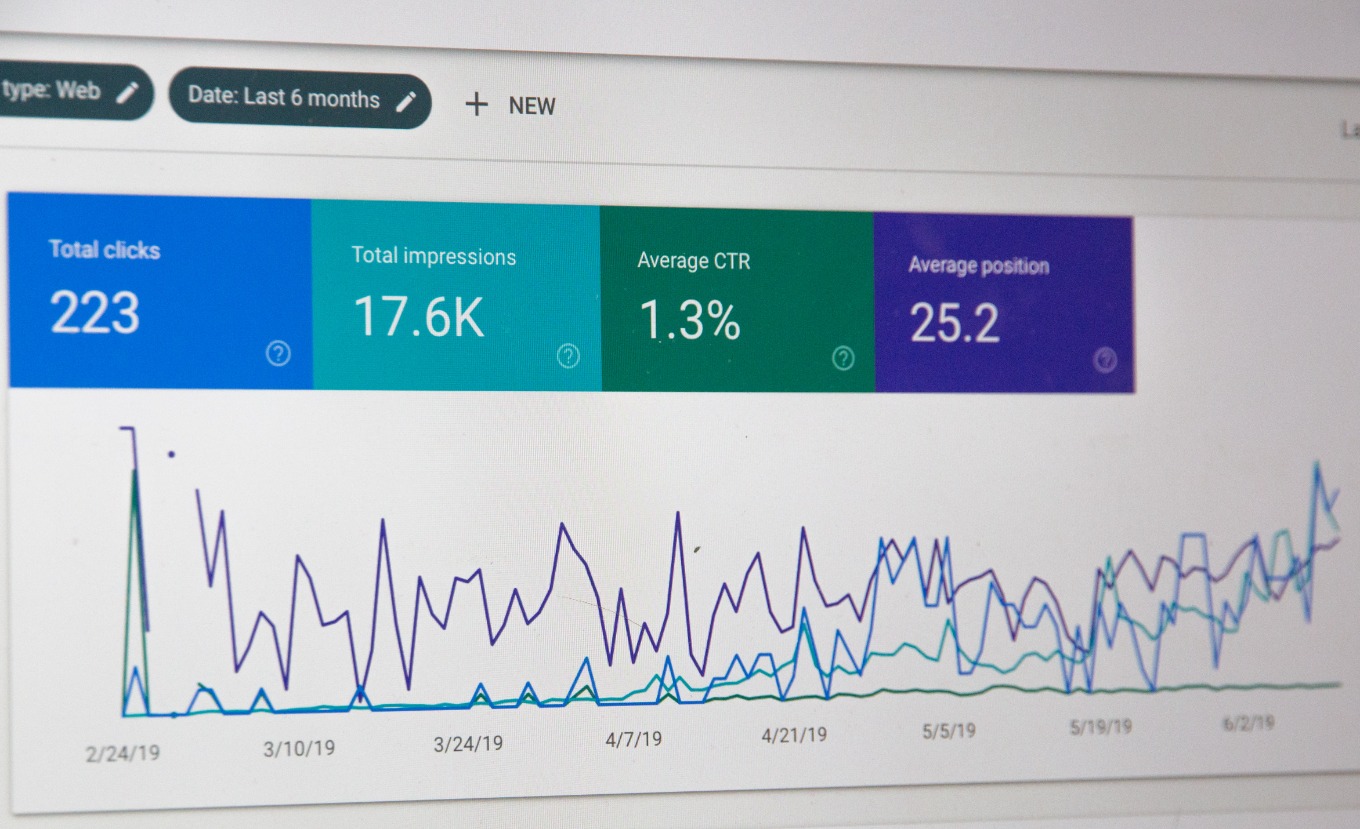

The promise of artificial intelligence and machine learning in tax software is only beginning to be realized. Machine learning algorithms can identify patterns and trends in large data sets, automate repetitive tasks, and offer personalized tax-saving recommendations. However, it's vital to understand that the efficacy of machine learning is heavily contingent on the quality and volume of data it has been trained on.

-

The Regulatory Landscape

Understanding the tax regulatory landscape is essential for anyone using personal income tax software. With the U.S. tax code stretching over 70,000 pages, even minor oversights can result in non-compliance and penalties. Hence, it's crucial to ensure that the chosen software is regularly updated to reflect the most recent tax laws and regulations.

In summary, the decision to invest in a personal income tax software is a multifaceted one. Informed choices stem from understanding the complexity and cost-benefit tradeoff, highlighting the importance of customer support and data security, staying abreast of AI's potential, and complying with the ever-evolving tax landscape. The wisdom encapsulated in these six points can significantly enhance the value derived from this indispensable tool in the digital age.

Informed choices stem from understanding the complexity and cost-benefit tradeoff, highlighting the importance of customer support and data security, staying abreast of AI's potential, and complying with the ever-evolving tax landscape.