About TaxAct

Dallas, TX, USA

When it comes to personal income tax software, consumers are often looking for a blend of user-friendliness, comprehensive features, and affordability. TaxAct seems to strike a balance in these areas, positioning itself as a competitive option for taxpayers seeking a do-it-yourself approach to filing their taxes online.

TaxAct's software platform is designed with the consumer in mind, offering a straightforward interface that simplifies the tax filing process. The software guides users through a series of questions and prompts to ensure that they are taking advantage of all applicable tax breaks and deductions. This guided experience can be particularly helpful for those who may not be tax-savvy or who may feel overwhelmed by the complexity of tax laws.

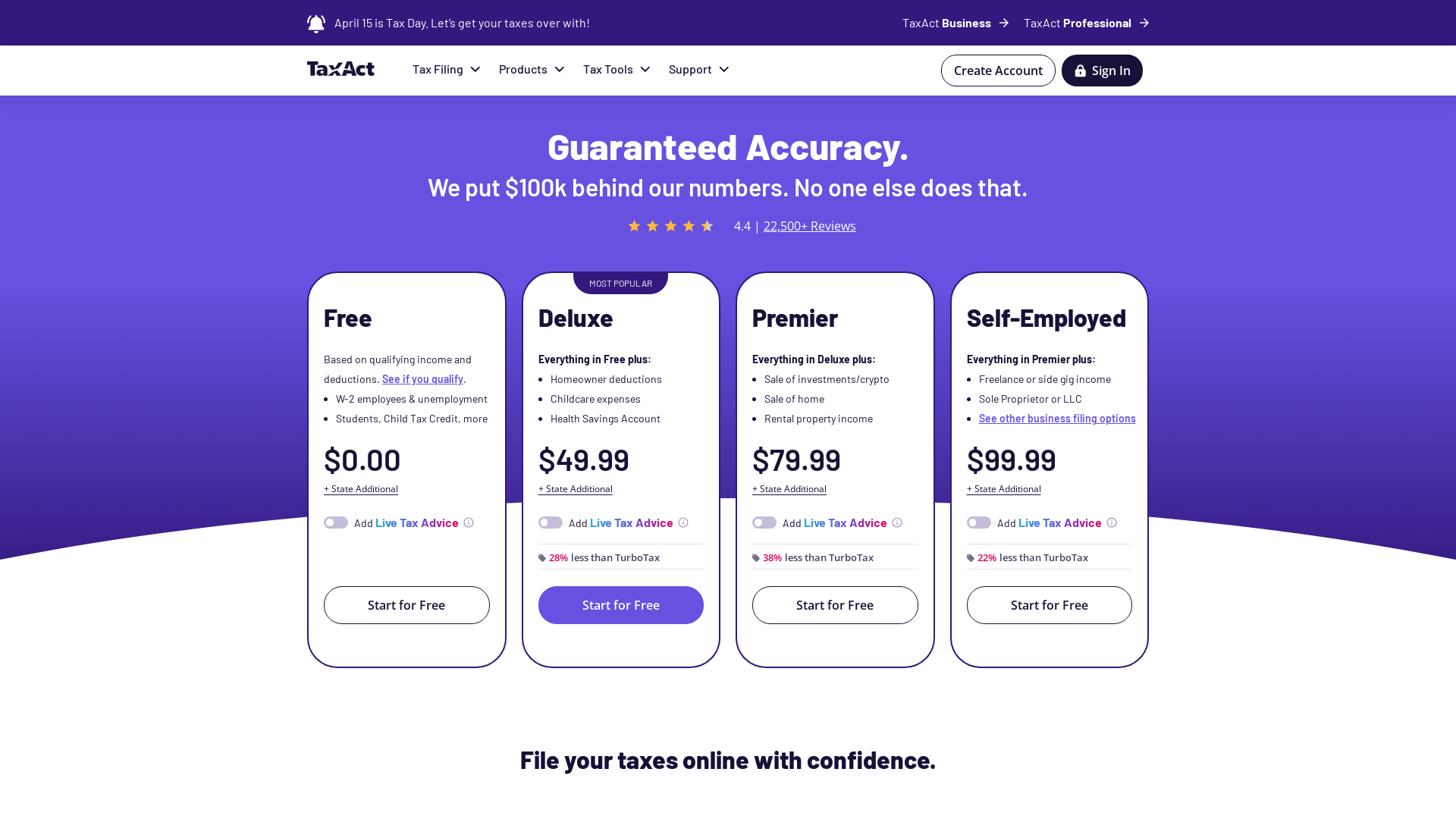

One of TaxAct's standout features is its Maximum Refund Guarantee, which pledges to get users the highest possible refund. This guarantee, combined with a $100k Accuracy Guarantee that promises compensation for any discrepancies caused by software errors, provides an extra layer of confidence and security for users. It's a clear signal that TaxAct is committed to accuracy and stands behind the reliability of its software.

Another commendable aspect of TaxAct is its transparency in pricing. Unlike some competitors who may lure customers with free offerings only to upsell essential services later, TaxAct is upfront about its pricing structure. This transparency is crucial for users who need to factor in the cost of filing their taxes without any surprises at the end of the process.

For professionals, TaxAct offers TaxAct Professional, a version of their software tailored to the needs of CPAs, EAs, and tax preparers. This specialized software includes tools for e-filing, comprehensive support, and is designed to handle the more intricate aspects of professional tax preparation.

TaxAct also recognizes the importance of data security, utilizing advanced encryption technology to protect users' sensitive information. In an age where data breaches are not uncommon, TaxAct's commitment to safeguarding personal and financial data is reassuring.

While TaxAct offers robust software, it does not neglect the human element. Their Xpert Assist feature, available for an additional fee, grants users unlimited access to live tax advice from professionals. This hybrid approach of combining software efficiency with human expertise can be particularly valuable for those facing more complex tax situations or for users who simply prefer having a professional to consult.

In the competitive realm of personal income tax software, TaxAct makes a compelling case for itself. It may not have the brand recognition of some of its larger competitors, but it holds its own with a user-friendly platform, strong guarantees, and a clear commitment to customer service. For taxpayers seeking a reliable and cost-effective way to file their taxes, TaxAct is certainly worth considering.

Fast Facts

- TaxAct provides a $100,000 accuracy guarantee to assure the correctness of their software calculations.

- TaxAct offers a Maximum Refund Guarantee, ensuring that users get the largest refund possible when filing with their software.

- The company's online tax filing services are designed to support a variety of tax situations, including federal and state DIY tax preparation.

- TaxAct Professional is a software product tailored for tax professionals such as CPAs and EAs, offering comprehensive tools and e-filing options.

- TaxAct's Deduction Maximizer feature guides users in identifying additional tax advantages to maximize deductions.

- Users can seek unlimited live tax advice through TaxAct's Xpert Assist service, available for an additional fee.

- TaxAct's software includes a user-friendly interface and provides tools to help import tax data, calculate deductions and credits, and maximize tax refunds.

- TaxAct has been used to e-file over 94 million returns since the year 2000.

Products and Services

- "Free Edition" - Online tax filing for simple returns with the ability to file using IRS Form 1040 without attaching any forms or schedules.

- "Deluxe Edition" - Online tax filing suitable for homeowners, with the option for itemized deductions, adjustments, and credits.

- "Premier Edition" - Online tax filing designed for investors and property owners, covering investment, rental property income, and foreign bank and financial accounts.

- "Self-Employed Edition" - Online tax filing tailored for freelancers, contractors, and sole proprietors, with a focus on business deductions and personalized support.

- "TaxAct Professional" - Tax preparation software aimed at tax professionals, providing tools for tax preparation, e-filing, and comprehensive support for accurate and timely tax returns.

- "Xpert Assist" - An add-on feature offering unlimited live tax advice and assistance from tax experts, available for consumer 1040 tax filing products.

Want to learn more?

Click here to check out the rest of our rankings and reviews.