-

Definitive Rankings

We work hard to come up with definitive, objective rankings. Learn more about our rankings

-

Superlative Quality

Only the top companies are ranked on our lists. Learn more about our standards

-

Objective Metrics

We use a set of advanced metrics to gauge each company. Learn more about our metrics:

Ranking: Best Personal Income Tax Software

Explore our expert rankings to find your ideal partner in the personal income tax software industry.

#1

PitBullTax Software

Coral Springs, FL, USA

PitBullTax is a leading tax resolution software in the US, designed to help CPAs, EAs, and tax attorneys streamline their processes. The software offers an array of features such as resolution evaluation, integrated IRS forms, a client portal, and case diagnostics, among others. With a user-friendly interface, it offers unique tools like Zoom integration and file synchronization with popular cloud storage options such as Dropbox, OneDrive, and Google Drive. Particularly impressive is their use of secure, password-protected emails for sending sensitive IRS forms. With a variety of pricing options and the inclusion of a 7-day free trial, PitBullTax presents a comprehensive and secure solution for tax professionals seeking to enhance efficiency and organization in their practices.

#2

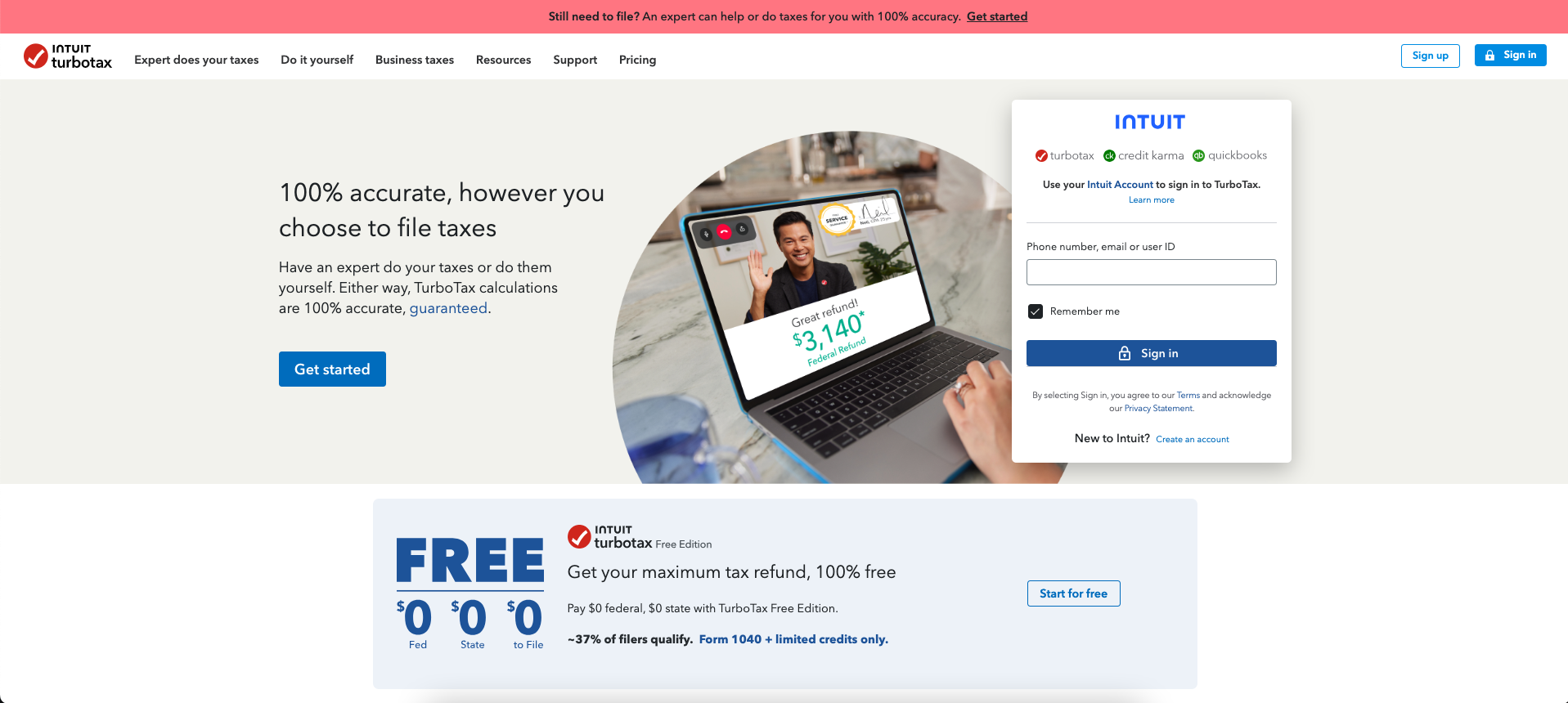

TurboTax

Mountain View, CA, USA

TurboTax, an industry-leading personal income tax software in the U.S, offers a comprehensive and user-friendly platform for tax filing. Designed to simplify the process, it provides users with a choice of handling their tax returns independently or with expert assistance. The service is particularly lauded for its versatile calculators and estimators, aiding in computations and providing clarity about potential refunds. Furthermore, the TurboTax platform includes a wealth of resources such as the latest tax law changes, military-specific tax information, and product reviews. In addition, the firm's commitment to accuracy and customer support, evident in their lifetime guarantee, makes it a reliable choice for tax filing.

#3

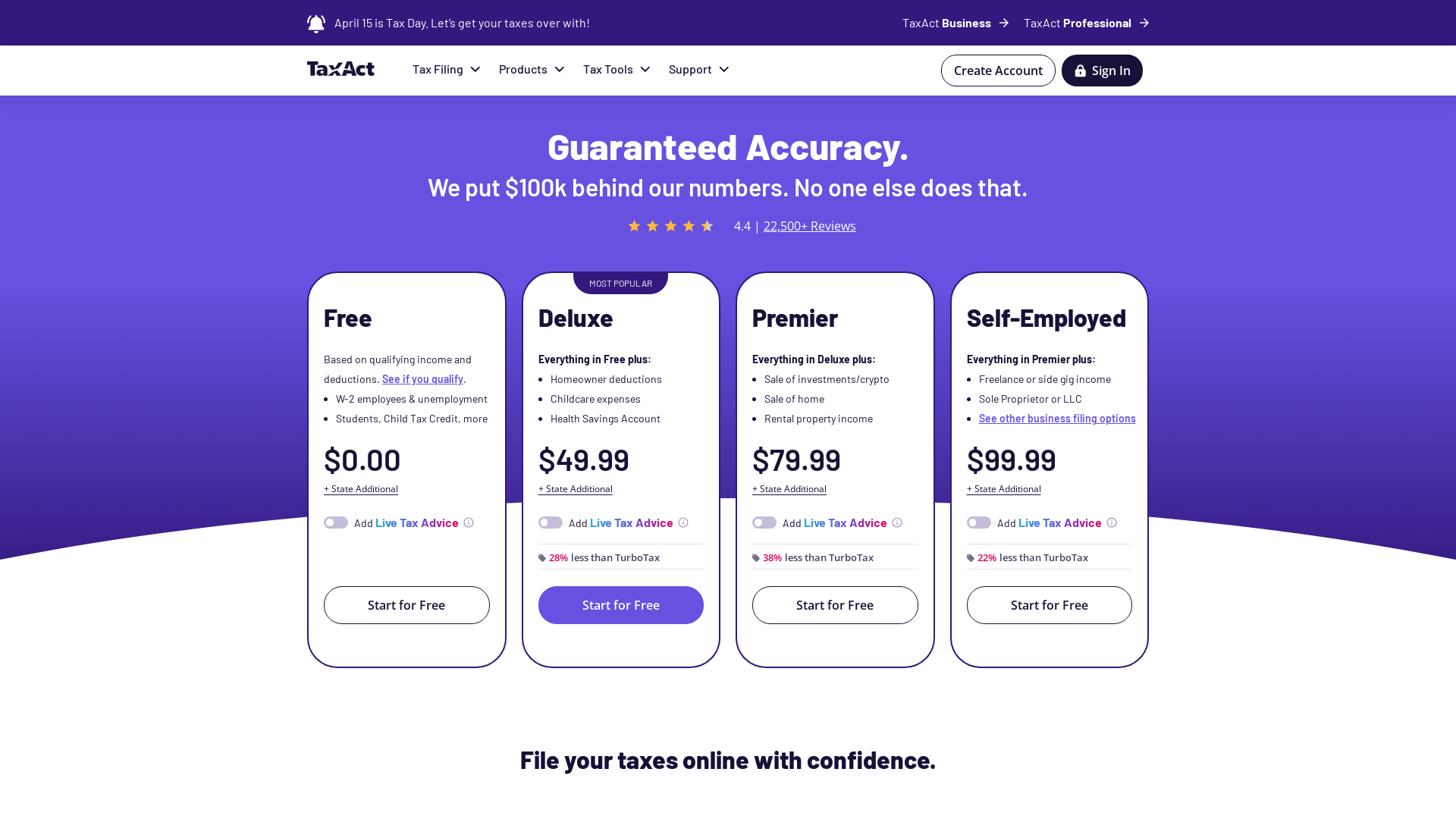

TaxAct

Dallas, TX, USA

TaxAct® stands out as a user-friendly, high-value tax filing software in the US market. With a robust $100k accuracy guarantee, the company instills confidence in its users, assuring them that its calculations are precise and reliable. TaxAct® offers a wide array of products to cater to varied tax situations, from free basic income tax filing to comprehensive packages for homeowners, investors, and self-employed individuals. The platform further distinguishes itself with its Xpert Assist™ service, offering personalized advice and tax return reviews from real tax experts. Moreover, its commitment to data privacy and security is evident in its advanced encryption technology and strict access controls. With a maximum refund guarantee and competitive pricing, TaxAct® presents a compelling choice for those seeking an efficient, reliable, and affordable tax filing solution.

#4

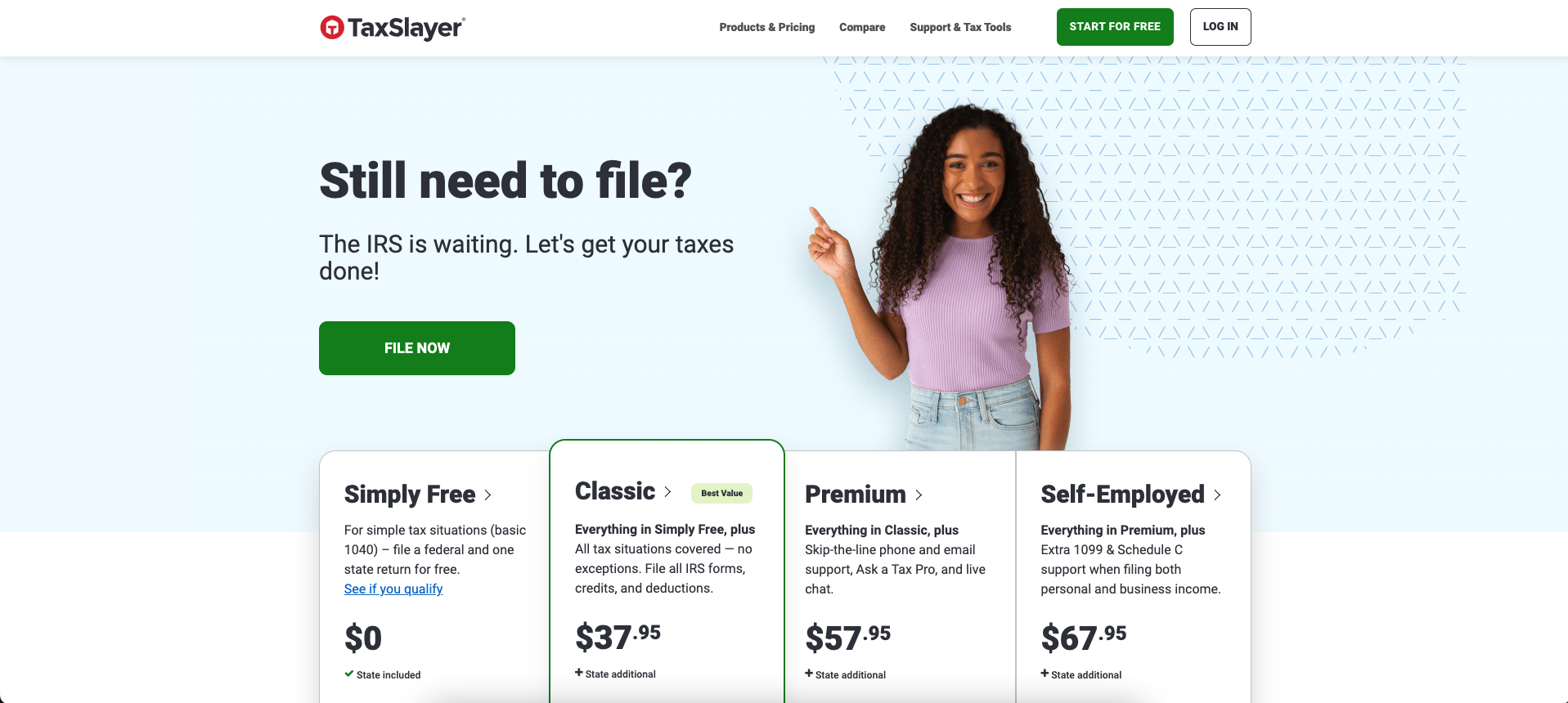

TaxSlayer

Atlanta, GA, USA

In the dynamic realm of personal income tax software, TaxSlayer strikes an impressive pose as a formidable contender. The company has robustly slayed the competition, earning its spot as the third best personal income tax software in the US. It's a digital David in a Goliath world, proving that a perfect blend of simplicity, affordability, and functionality can indeed emerge triumphant. This nimble tax solution juggles user-friendly features and comprehensive tax code coverage with the grace of an expert juggler. TaxSlayer, with its intuitive interface and a plethora of features, is a splendid choice for those looking to slay their tax concerns without breaking a sweat.

#5

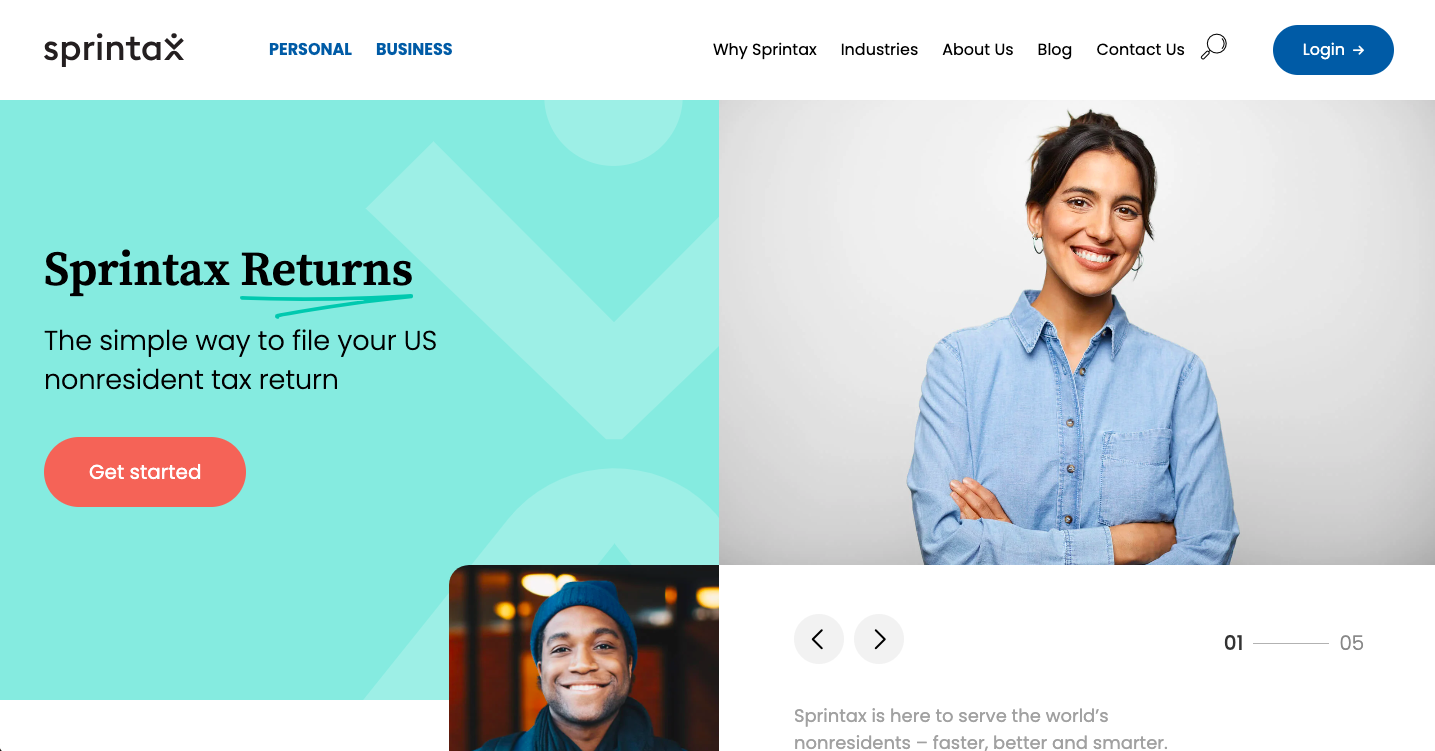

Sprintax

New York, NY, USA

Sprintax is a US-based income tax software provider that caters particularly to nonresident aliens. Their platform offers an extensive range of services, such as personal tax return filing, pre-employment tax forms preparation, and assistance with reclaiming overpaid dividend withholding tax. A unique selling point lies in their 'Sprintax Calculus' feature - a multi-jurisdiction tax compliance software that simplifies payroll processing for employers of nonresidents. Sprintax also stands out for its commitment to compliance, integrating real-time data reporting and a secure cloud framework to ensure data protection at all times. Their user reviews praise their responsive customer service and easy-to-use interface, cementing their reputation as a reliable, user-friendly solution for nonresident tax filing needs.

#6

EZFile NOW

Temecula, CA, USA

EZ File Now is a comprehensive tax preparation and consultancy service that caters to a broad spectrum of clientele, from individuals to businesses. The company stands out for its blend of technology and personal touch. Its software, aimed at tax professionals, is known for its efficiency and speed, setting it apart in the competitive tax preparation market. Yet, it's their human approach that truly impresses; their team of tax professionals provides personalized solutions tailored to each client's unique tax situation, a strategy that aims to minimize tax liabilities and maximize refunds. The range of services is impressive, covering everything from basic federal tax preparation to more complex aspects such as expatriate taxes and business filings. For those seeking to secure their financial future or navigate the often confusing tax landscape, EZ File Now appears to be a reliable, client-focused choice.

#7

TaxHawk

Provo, UT, USA

If you've been on a quest to discover the best personal income tax software, look no further than TaxHawk. This digital bird of prey is not your average tax software, it swoops in with an intuitive interface, robust features, and surprisingly cost-effective pricing. It's a rare creature in the realm of tax software, prioritizing the user experience without compromising on the quality of its service. With its advanced tools, it makes navigating the labyrinth of tax filing seem like a walk in the park. TaxHawk has proven itself to be a formidable contender, soaring above many in the personal income tax software category.

#8

UltimateTax

Muscatine, IA, USA

UltimateTax has firmly established itself as a leading figure in the professional tax software industry for over a decade. It offers a robust and secure tax software environment, ensuring the safety of data for tax preparers. The company's diverse product line caters to a broad range of professionals, from novice tax preparers to seasoned experts, and from small business owners to large enterprises. Noteworthy features include automatic data conversion from previous tax programs, time-saving automatic software updates, and compatibility with Mac, Windows, and Linux computers. The pricing structure is also flexible, with options that range from a pay-per-return basis to unlimited user access for larger tax offices. Overall, UltimateTax is a comprehensive solution for any tax preparation business seeking to streamline its operations and grow.

#9

H&R Block

Kansas City, MO, USA

H&R Block is a noteworthy player in the personal income tax software industry, offering a range of services to suit various tax filing needs. Their platform simplifies the tax filing process with easy-to-use tools, step-by-step guidance, and real-time support from tax professionals. The company also stands out with its mobile app, Spruce, catering to those who prioritize efficient money management. H&R Block's additional features, such as tax refund tracking and tax identity theft protection, further enhance their comprehensive service offering. Despite the array of benefits, potential users should be aware of additional fees that may apply for expert support. Overall, H&R Block presents a robust tax solution that marries convenience with expertise.

#10

ComplyRight, Inc.

Pompano Beach, FL, USA

ComplyRight, a prominent player in the landscape of workplace compliance solutions, offers an array of services to businesses in the US. Their offerings range from employee management, hiring, time and attendance tracking to record-keeping, training, and safety. It's noteworthy that they provide meticulously detailed labor law compliance solutions like the Poster Guard and other electronic posters, ensuring businesses stay on the right side of the law. Their tax information reporting is a boon for companies, simplifying the often tangled process of filing 1099s, W-2s and ACA forms. With a clear mission to unburden employers from compliance complications, ComplyRight provides an essential service, enabling companies to focus more on growth and less on red tape.

Our Mission

At Best Personal Income Tax Software, our mission is to empower individuals across the United States by providing incisive, reliable, and straightforward evaluations of personal income tax software. We meticulously scrutinize each software option, yielding rankings that illuminate the strengths and weaknesses of each contender. Our objective is to simplify the oftentimes overwhelming task of tax filing, enabling users to make well-informed decisions that fit their unique needs. Ultimately, we strive to demystify the tax process, creating a more accessible, efficient, and stress-free experience for all.

Are personal income tax software worth it?

When considering the benefits of personal income tax software, it's essential to weigh the convenience it offers in simplifying complex tax calculations and ensuring accurate submissions. The efficiency gained in streamlining the tax filing process can lead to potential savings of time and money, making the investment in such software a prudent choice for many individuals.

What to look for when hiring personal income tax software?

At Best Personal Income Tax Software, we understand that choosing the right tax software can be a complex process, filled with unique jargon and intricate considerations. To help you navigate through this, we've curated a comprehensive list of Frequently Asked Questions (FAQs). This resource is designed to shed light on common queries, alleviate uncertainties and provide clarity on the specifics of personal income tax software. Whether you're exploring options for the first time or you're a seasoned user looking for a better fit, our FAQs aim to simplify your decision-making process, ensuring you have the necessary insights to select the most suitable tax software for your needs.

Do I have the necessary knowledge and understanding to use this software effectively?

Understanding and effectively using personal income tax software requires a base level of financial literacy and familiarity with tax concepts. These programs, while designed to simplify the tax filing process, still require users to provide accurate financial information and make informed decisions based on their personal tax situations. Most software includes guidance and explanations of tax terms and concepts, which can be helpful for beginners. However, if your tax situation is complex or you lack confidence in your understanding of tax laws, you might benefit from consulting a tax professional. Ultimately, the right software should make the process more manageable, providing clear instructions and support, and should cater to your level of tax knowledge.

Does the software support the specific tax forms and situations relevant to my personal income tax?

The support for specific tax forms and situations relevant to personal income tax is a crucial aspect to consider when choosing a personal income tax software. It is important to ensure that the software you choose can accurately and efficiently handle your unique tax situation. This may include support for various forms such as W-2, 1099, Schedule C, or other relevant forms, as well as handling situations like self-employment, rental income, or investment income. Most leading tax software companies provide a comprehensive list of the forms and situations they support on their websites. Therefore, a thorough research and comparison of these features across different software options can assist you in making an informed decision that best suits your personal income tax needs.

Is the software within my budget and does it provide good value for its cost?

When evaluating personal income tax software, budget and value are key considerations. Firstly, you should determine your financial boundaries for such a tool - remember, these products range from free versions to more advanced options with associated costs. The value of the software is not just about its price, but also the features and benefits it offers. Look for a product that can handle your specific tax situation, whether that's self-employment income, rental properties, or investments. Furthermore, consider the support and guidance offered by the software, as this can greatly enhance its value, especially if you're new to filing your own taxes. Finally, read objective reviews and comparisons of different software to make an informed decision that balances your budget and the value you're receiving.

Key Takeaways about personal income tax software

When considering personal income tax software options, it's essential to prioritize user-friendliness and accessibility. Look for software that offers a clear interface and straightforward navigation to streamline the filing process. Additionally, ensure the software supports all necessary tax forms and calculations, minimizing the risk of errors. It's wise to opt for a program with robust customer support to address any questions or issues promptly. Lastly, consider the cost of the software and any additional fees for upgrades or support services to make an informed decision that aligns with your budget and needs.

Frequently Asked Questions

When choosing personal income tax software, consider its user-friendliness, accuracy, and security.

A good software will have an intuitive interface, making it easy for you to input data and understand tax calculations.

It should also provide accurate results, updated with the latest tax laws to ensure your compliance.

Lasty, prioritize software with robust security measures to protect your sensitive financial information.

Personal income tax software streamlines the tax filing process by automating complex calculations, identifying potential deductions, and ensuring tax compliance. It offers guidance and support, reducing the risk of human errors and making tax filing more efficient.

Such software can also handle various tax scenarios, making it easier for users to navigate their unique financial landscape.

Personal income tax software offers several benefits over hiring a tax professional. It's generally more cost-effective, with many offering free or low-cost options compared to the often high fees of a tax professional.

Tax software also offers flexibility, allowing you to work on your taxes at your own pace and on your own schedule.

Additionally, many tax software options are user-friendly and designed to guide even the most novice users through the process with ease, eliminating the need for advanced tax knowledge.

While personal income tax software significantly simplifies the tax filing process, you might encounter challenges such as navigating complex tax situations, understanding tax jargon, or dealing with software glitches.

The software's accuracy relies heavily on the information you input, so any mistakes can lead to errors in your tax return.

Lastly, not all tax software supports every tax form, which could limit their use for some users.

Always research and compare various software to ensure it suits your specific needs.

Yes, personal income tax software can indeed assist with tax planning and future projections. These digital tools often include features that allow you to estimate your taxes for the upcoming year, based on your income and expenses. The software can also provide advice on potential tax-saving strategies, enabling you to plan more effectively. However, the accuracy and comprehensiveness of these features can vary, so it's essential to choose software that suits your specific needs.

Personal income tax software is generally safe and secure to use, as reputable providers prioritize data protection. These services often utilize advanced encryption technology and two-factor authentication to secure your sensitive information.

However, it's essential to conduct thorough research and choose a software with robust security features and good reviews. Always remember, the safety also depends on your practices like using strong passwords and maintaining up-to-date software.

To ensure a personal income tax software is compliant with the latest tax laws and regulations, confirm that the software regularly updates for changes in tax legislation.

Check for a record of timely, consistent updates in response to new tax laws. Most reputable software providers will highlight their commitment to current tax compliance on their websites or in product descriptions.

Additionally, reading user reviews and third-party evaluations can offer insight into the software's reliability and regulatory adherence.

Yes, personal income tax software can indeed handle complex tax situations such as self-employment, rental properties, and investments. These software are designed to guide users through a myriad of tax scenarios, offering tailored advice and computations for a variety of income sources. However, the level of complexity that can be handled may vary from software to software, so it's crucial to compare features and reviews before making your choice.

Personal income tax software is typically updated annually to accommodate changes in tax law. These updates are essential to ensure the software remains compliant with the latest regulations and can accurately calculate your tax liability.

However, more frequent updates may occur if there are significant tax law changes within the year. It's important to verify that the software you choose is timely with its updates to avoid any potential discrepancies in your tax filing.

Yes, personal income tax software is designed to assist with both federal and state tax returns. These programs simplify the process by guiding users through their tax forms, automatically calculating totals, and identifying potential deductions.

It's worth noting that while most software can handle federal returns, state return assistance might require an additional cost or be included in premium versions of the software. Always compare features and costs to ensure you're selecting the best personal income tax software for your specific needs.

Yes, personal income tax software is designed to cater to a variety of needs, including both individuals and small businesses. These applications assist in simplifying the tax preparation process, ensuring accuracy, and maximizing deductions. They vary in features and complexity, with some specifically tailored for self-employed or small business scenarios, including handling aspects like self-employment income, expenses, and tax deductions. Therefore, when choosing a tax software, it's important to compare different options and select the one that best fits your personal or business tax situation.

Personal income tax software generally offers robust customer support to guide users through the tax preparation process. This often includes live chat options, phone support, and email assistance from tax professionals. Some software providers even offer comprehensive FAQ sections or user forums for self-guided assistance. The level of support can vary between providers, making it an important consideration when comparing personal income tax software options.

Are you interested in being evaluated for next year's list?

Contact Us