5 Reasons Why You Absolutely Need Personal Income Tax Software

The concept of taxation is as old as civilization itself, dating back to the ancient Egyptians in 3000-2800 B.C, who imposed taxes on cooking oil. However, the complexity and intricacy of modern tax systems demand a significant degree of dexterity and comprehension that transcends the rudimentary arithmetic. For those without a background in finance or law, wading through the labyrinthine tax code is not only daunting but also time-consuming and mentally exhausting. This is where Personal Income Tax Software (PITS) comes into play, offering a user-friendly platform to simplify the tax filing process. Let's delve into five compelling reasons that underline the necessity of using PITS.

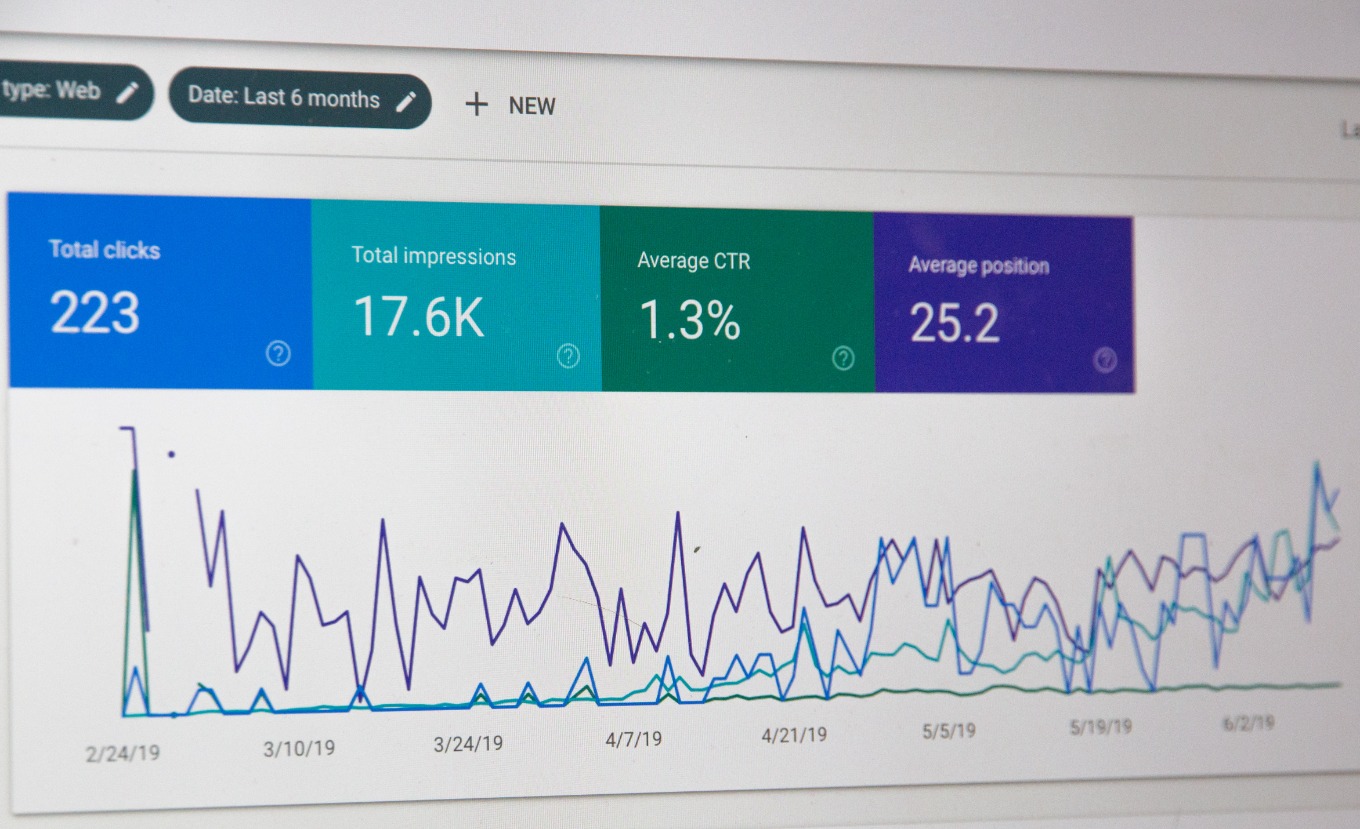

First, PITS significantly reduces the margin of error. The Internal Revenue Service (IRS) reported that the error rate for paper returns was 21%, compared to a mere 0.5% for e-filings in 2019. Why such a stark contrast? This is attributable to the automated calculations, in-built error checks, and intuitive prompts that these software provide, thereby minimizing the risk of simple human errors.

Second, PITS empowers users with the flexibility to file taxes at their own pace. It's no secret that tax season can be stressful, with time constraints, appointment schedules, and a flood of paperwork. PITS is available 24/7, providing the autonomy to work on your tax return anytime, anywhere, thus reducing the psychological load of tax filing.

Third, PITS provides cost efficiency. Hiring a tax professional or an accountant to handle your taxes will undoubtedly result in a hefty bill. PITS is a cost-effective alternative that automates complex calculations and ensures tax compliance without eroding your wallet. Plus, most PITS offer different pricing tiers tailored to your specific requirements, ranging from a basic free version to a premium version for complex tax situations.

Fourth, the dynamic nature of tax laws makes it challenging for the average individual to stay up-to-date. Frequent changes and amendments require constant vigilance, and failure to comply can result in penalties. PITS, however, is updated regularly to reflect the latest tax laws and regulations, ensuring compliance without the burden of continuous learning.

Finally, PITS not only files your taxes but also aids in optimizing your tax return. From identifying applicable tax deductions and credits to providing tax planning advice, PITS maximizes your refund or minimizes your liability, thus positively impacting your financial health.

In conclusion, the benefits offered by PITS are not just additive; they are exponential. By diminishing the error rate, providing flexibility, ensuring cost efficiency, adapting to changing laws, and optimizing returns, PITS fundamentally transforms the way we perceive and handle income tax. It's no longer a question of whether one can afford to use PITS, but rather whether one can afford not to.

In an era where data is the new currency, technology is the catalyst propelling us into an age of digital tax management. As Albert Einstein famously said, "The hardest thing in the world to understand is the income tax." With Personal Income Tax Software, understanding and managing income tax is no longer an uphill battle but a walk in the park.

With Personal Income Tax Software, understanding and managing income tax is no longer an uphill battle but a walk in the park.