Personal Income Tax Software Industry Report: Unveiling Key Findings and Crucial Insights

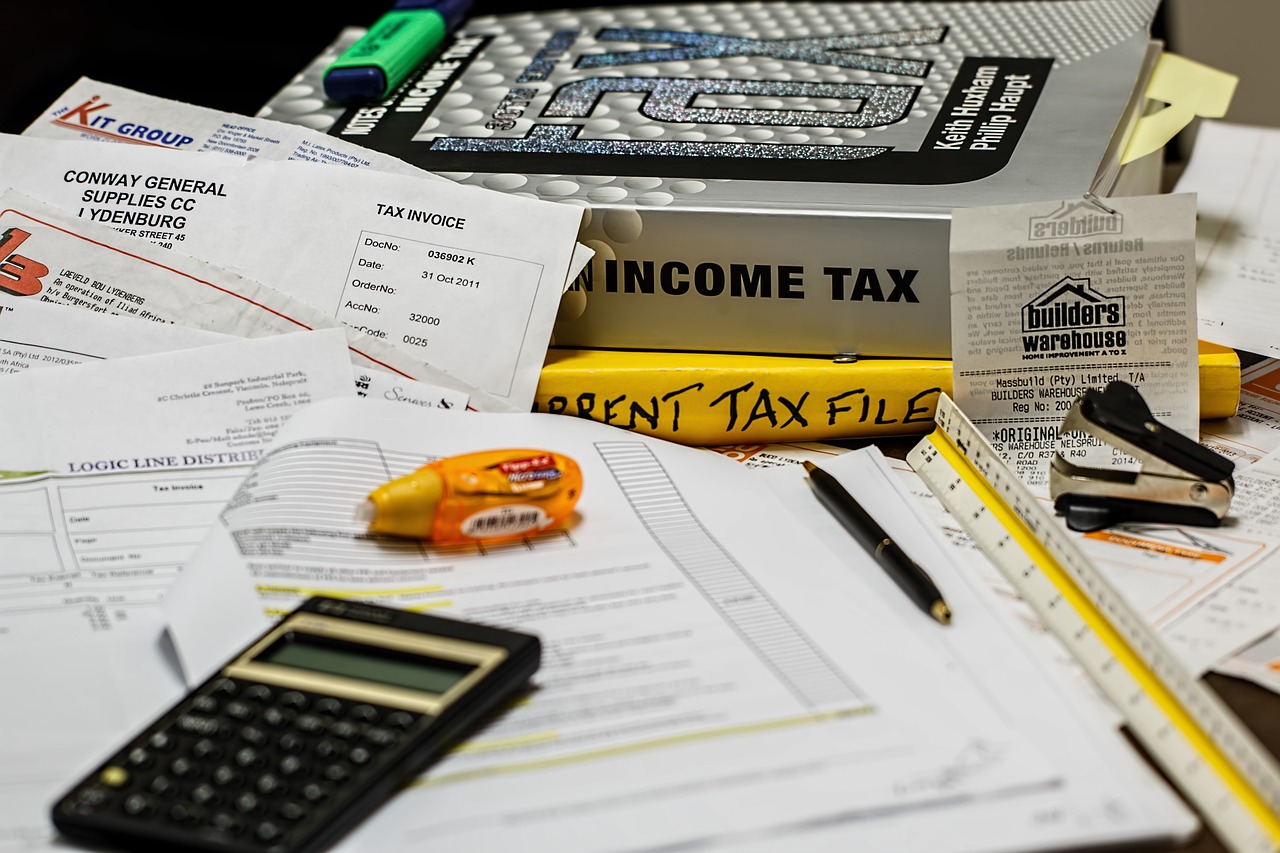

The annual tax filing season is anticipated with a mix of dread and resignation by many, a sentiment that has led to the rise and popularity of personal income tax software. This burgeoning industry has revolutionized the way we approach our tax responsibilities, making the process more streamlined and accessible to the average individual.

Delving into the intricate world of personal income tax software, certain revelations are brought to light that reflect the dynamics of this industry and its influence on the taxpayers. The amalgamation of data analytics, artificial intelligence, and user-centered design has given birth to software that not only simplifies the process but also ensures better accuracy and compliance.

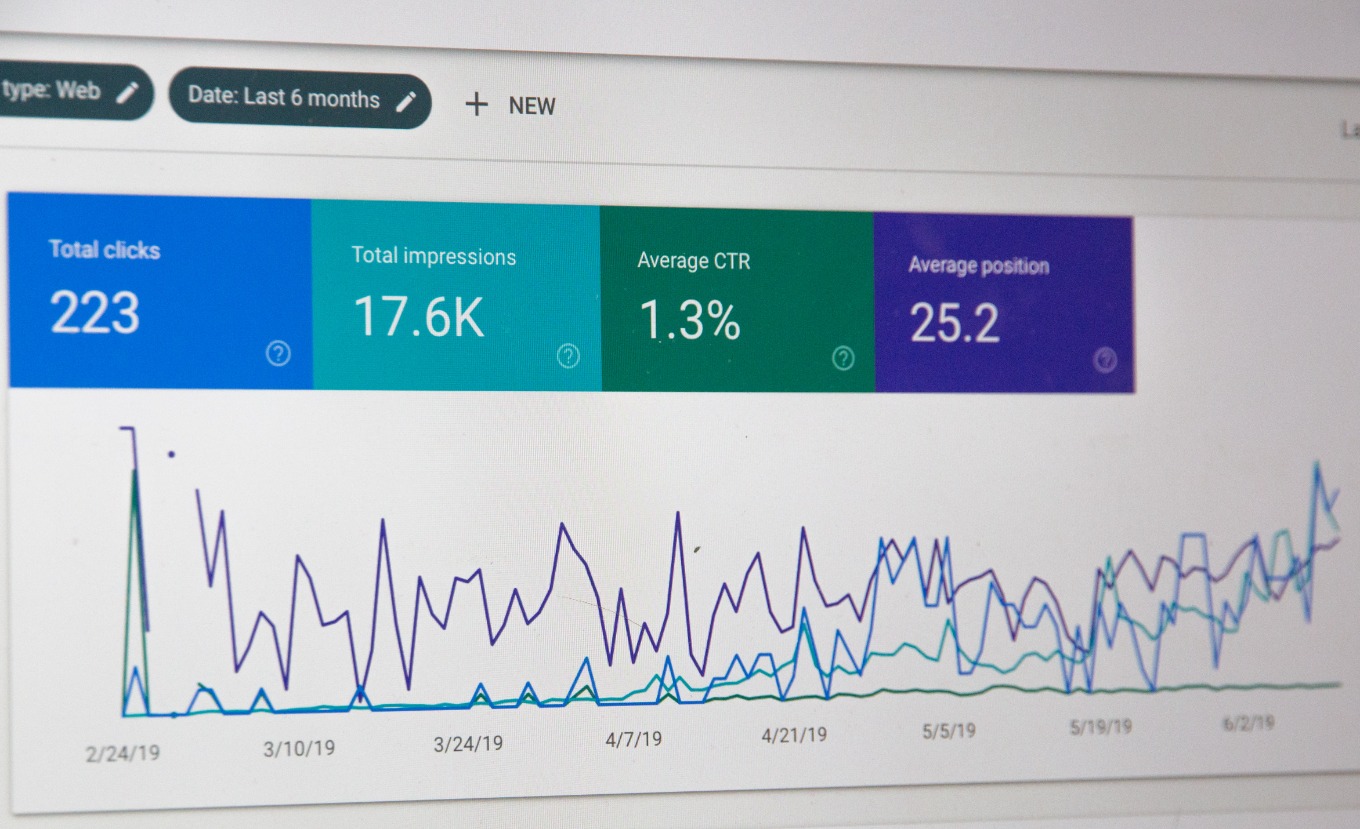

One of the key findings is the significant impact of technological innovation on the personal income tax software industry. The use of AI and machine learning, for instance, has equipped these software applications with capabilities to deduce complex tax regulations and provide tailored recommendations based on the user's specific income details and tax situation. This has significantly reduced the margin of error, a critical element considering the repercussions of incorrect tax filing.

Moreover, the industry has witnessed a clear shift towards cloud-based solutions. Cloud technology has made it possible for users to access and manage their tax details from anywhere, at any time. This has not only provided convenience but also enhanced data security, as cloud platforms are typically equipped with advanced encryption and multiple-layered security measures.

The significance of user-centered design in this industry cannot be overstated. Personal income tax software has matured from being merely functional to becoming exceedingly intuitive. The emphasis on user experience design has made these applications more approachable and less intimidating to the average user. This transformation is seen as a critical factor in the rapid adoption of these software applications, as it has effectively demystified the tax filing process.

However, the industry is not without its challenges. Regulatory compliance is a constant concern, as tax laws are complex and continually evolving. The software must be consistently updated to align with new tax laws and regulations.

Additionally, data privacy and security are of paramount importance. The software handles sensitive personal and financial information, making it a potential target for cybercriminals. Companies must invest heavily in advanced security measures to protect user data and build trust among users.

The future of the personal income tax software industry appears promising, albeit challenging. The advent of AI and machine learning brings with it the promise of smarter, more efficient tax software, while the shift towards cloud-based solutions presents opportunities for flexibility and scalability.

On the flip side, the industry must grapple with ever-changing tax regulations and the urgent need for robust data security. While these challenges are significant, the potential benefits for users are considerable. The ability to file taxes accurately and efficiently, with minimal stress, is a powerful proposition that is likely to propel the industry's growth in the coming years.

In conclusion, the personal income tax software industry is in a phase of dynamic growth and evolution. Embracing AI, machine learning, and cloud technology, it's clear that the way we manage our taxes is being transformed. However, the industry must navigate regulatory compliance and data security challenges to continue offering value to users. The industry's future hinges on its ability to continue innovating while maintaining trust and reliability, factors that are crucial to its success.

The amalgamation of data analytics, artificial intelligence, and user-centered design has given birth to software that not only simplifies the process but also ensures better accuracy and compliance.