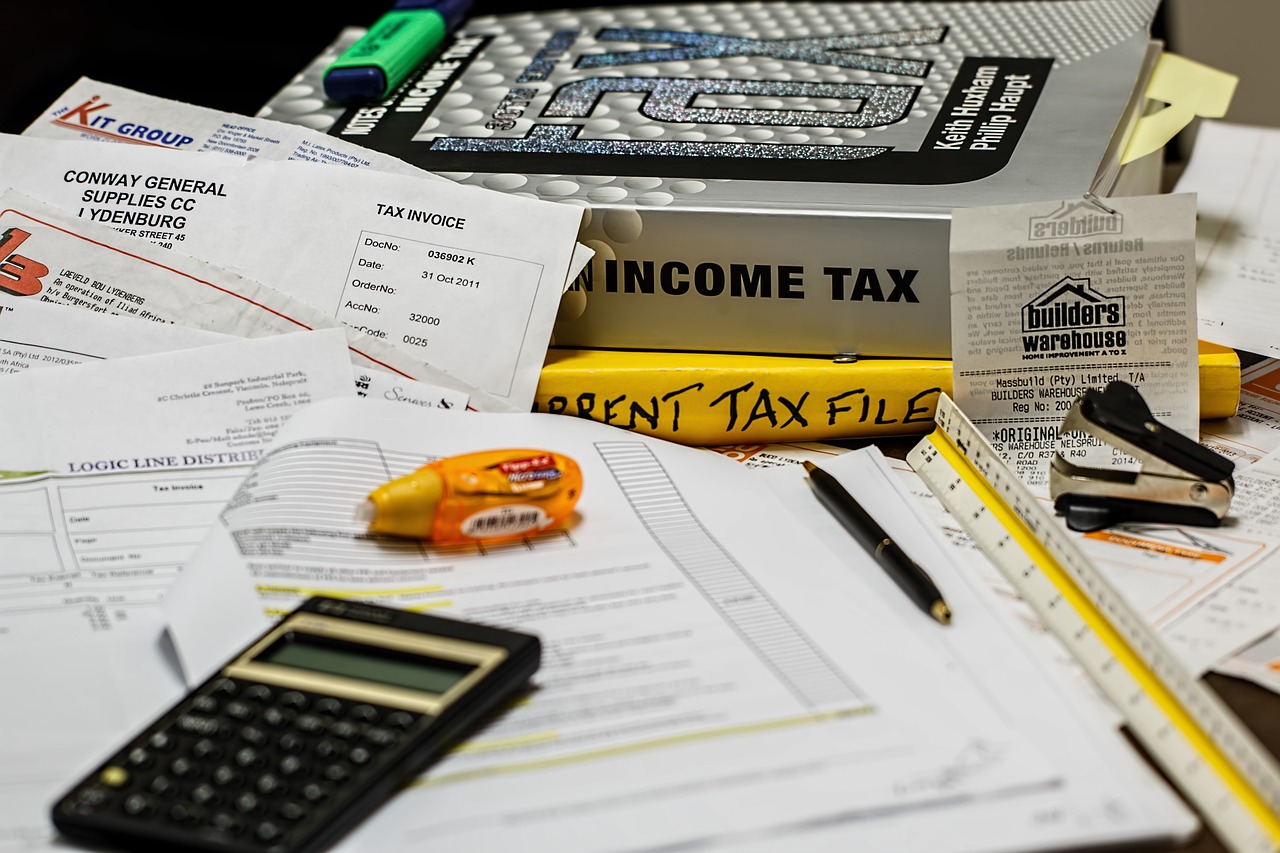

How to Budget for Personal Income Tax Software: A Comprehensive Guide

Personal income tax software has revolutionized the way we calculate, record, and file our taxes, marking a substantial paradigm shift from the traditionally complex and laborious manual process. However, these digital solutions come at a cost that needs to be factored into our personal and business budgets. This article aims to provide a comprehensive guide on how to budget for personal income tax software.

At the apex of budgeting considerations is an understanding of the functionality and utility of personal income tax software. Essentially, these technology-based tools simplify the tax preparation process by guiding taxpayers through their returns step-by-step, ensuring accuracy, optimizing deductions, and facilitating effortless e-filing. The software's inherent value proposition hinges on saving time and reducing errors, which can translate to significant monetary savings in the form of reduced accounting fees and minimized tax liabilities.

In the realm of personal income tax software, there exists a spectrum of products tailored to different needs, translating to varying price points. On one end, there are basic versions designed for individuals with straightforward tax situations, such as those only having W-2 income and taking the standard deduction. Conversely, the other end of the spectrum hosts premium software equipped with sophisticated features to handle complex tax scenarios, such as self-employed income, rental properties, and investment income.

To budget effectively, one must embark on a strategic evaluation of their unique tax situation. This involves a detailed analysis of your annual income, types of income, deductions, credits, and any other pertinent tax-related factors. Moreover, consider whether you anticipate any changes in your tax scenario in the upcoming year, such as purchasing a home, starting a business, or retiring.

When it comes to selecting the right software, the process becomes a balancing act between cost and functionality. A common pitfall is overbuying, that is, purchasing more expensive software with advanced features that you may not need. Alternatively, opting for cheaper software that fails to fully address your tax situation can lead to missed deductions and potential errors. An optimal compromise necessitates comprehensive research, comparison, and an in-depth understanding of one's personal tax needs.

Another significant factor to account for is the dynamic nature of personal income tax software pricing. Prices tend to rise as the tax deadline approaches. Early purchase, thus, allows you to capitalize on lower prices, which can result in substantial savings.

The cost of personal income tax software is not a one-time expense but an annual one. This is because tax laws change frequently and the software needs to be updated annually to reflect these changes. When creating your budget, it is crucial to consider this as a recurring expenditure.

Lastly, while budgeting, consider the opportunity cost of manual tax preparation or hiring an accountant. Apart from the monetary cost, think about the time and effort you could save by using tax software. This is especially relevant in an era characterized by the "time-is-money" ethos, where opportunity costs can eclipse actual financial costs.

In conclusion, budgeting for personal income tax software is a multidimensional process that requires a keen understanding of one's tax situation, a strategic evaluation of software options, a consideration of timing, and the contemplation of opportunity costs. With a careful and thoughtful approach, you can find an affordable solution that simplifies tax preparation, ensures accuracy, and ultimately, saves money.

This article aims to provide a comprehensive guide on how to budget for personal income tax software.