Debunking 10 Myths About Personal Income Tax Software: A Comprehensive Insight

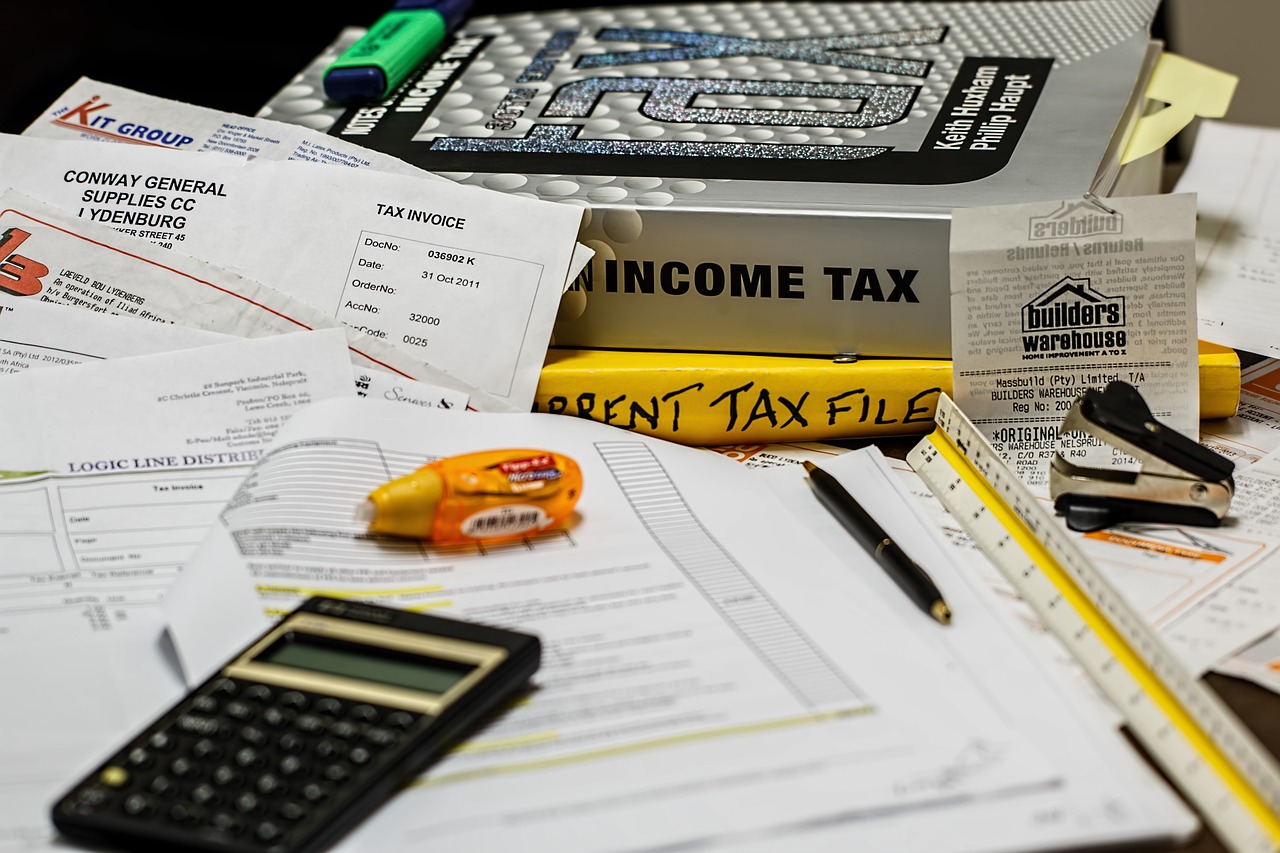

There are innumerable misconceptions, half-truths, and outright myths about personal income tax software that circulate in casual conversation, social media, and even in some professional circles. It is high time we separate the wheat from the chaff and lay bare the reality of these tools. This post aims to debunk ten of the most common myths about personal income tax software and provide comprehensive insight into their functioning, utility, and impact.

- Myth: Tax software makes errors in calculations

- Myth: Using tax software is more time-consuming than manual filing

- Myth: Tax software can't handle complex tax situations

- Myth: Filing taxes online is not secure

- Myth: Using tax software results in more audits

- Myth: Tax software is expensive

- Myth: Tax software is not user-friendly

- Myth: Tax software lacks human touch

- Myth: Tax software doesn't offer tax planning advice

- Myth: Tax software can't keep up with tax law changes

Fact: Personal income tax software is meticulously designed and is constantly updated to ensure accuracy in tax calculations. These tools employ sophisticated algorithms and have in-built validation and error-checking features that minimize the possibility of calculation errors. The software developers' employ rigorous testing strategies, comparable to those used in the development of high-reliability systems like avionics or medical technologies, to ensure accuracy. While there may be margin for error in manual calculations, these software systems, when operated correctly, are remarkably accurate.

Fact: Personal income tax software can save significant amounts of time compared to manual tax preparation and filing. The software provides an intuitive interface and step-by-step guidance, and it automates complex calculations, which collectively streamline the tax preparation process. A study by the American Economic Association found that taxpayers who used software spent 35% less time on their returns than those who did not.

Fact: Personal income tax software is designed to handle a broad range of tax situations, from the simple to the complex. The advanced versions of these software packages are equipped to deal with intricate tax scenarios such as self-employment, rental income, capital gains, and even international tax situations.

Fact: Personal income tax software uses robust security measures including advanced encryption technology to protect users' sensitive information. In fact, the Internal Revenue Service encourages electronic filing due to its security advantages over traditional paper filing.

Fact: There is no empirical evidence to suggest that using tax software increases the likelihood of being audited. Audit selection is based on a complex algorithm used by the IRS that considers factors such as income, expenses, and discrepancies in the information provided.

Fact: While there are costs associated with using tax software, the benefits often outweigh the cost. In addition to providing a time-efficient and accurate method for tax preparation, many software packages offer additional features like audit defense, which would typically cost extra if procured independently. Moreover, free versions of tax software are available for taxpayers with simpler tax situations.

Fact: Tax software developers invest significantly in user experience design to make their products as intuitive and user-friendly as possible. Most provide a step-by-step guide through the tax filing process, making it manageable even for those who are not particularly tech-savvy.

Fact: While it's true that using software lacks the personal element of working directly with a human tax preparer, many tax software companies offer live support from tax professionals to answer questions and provide assistance during the process.

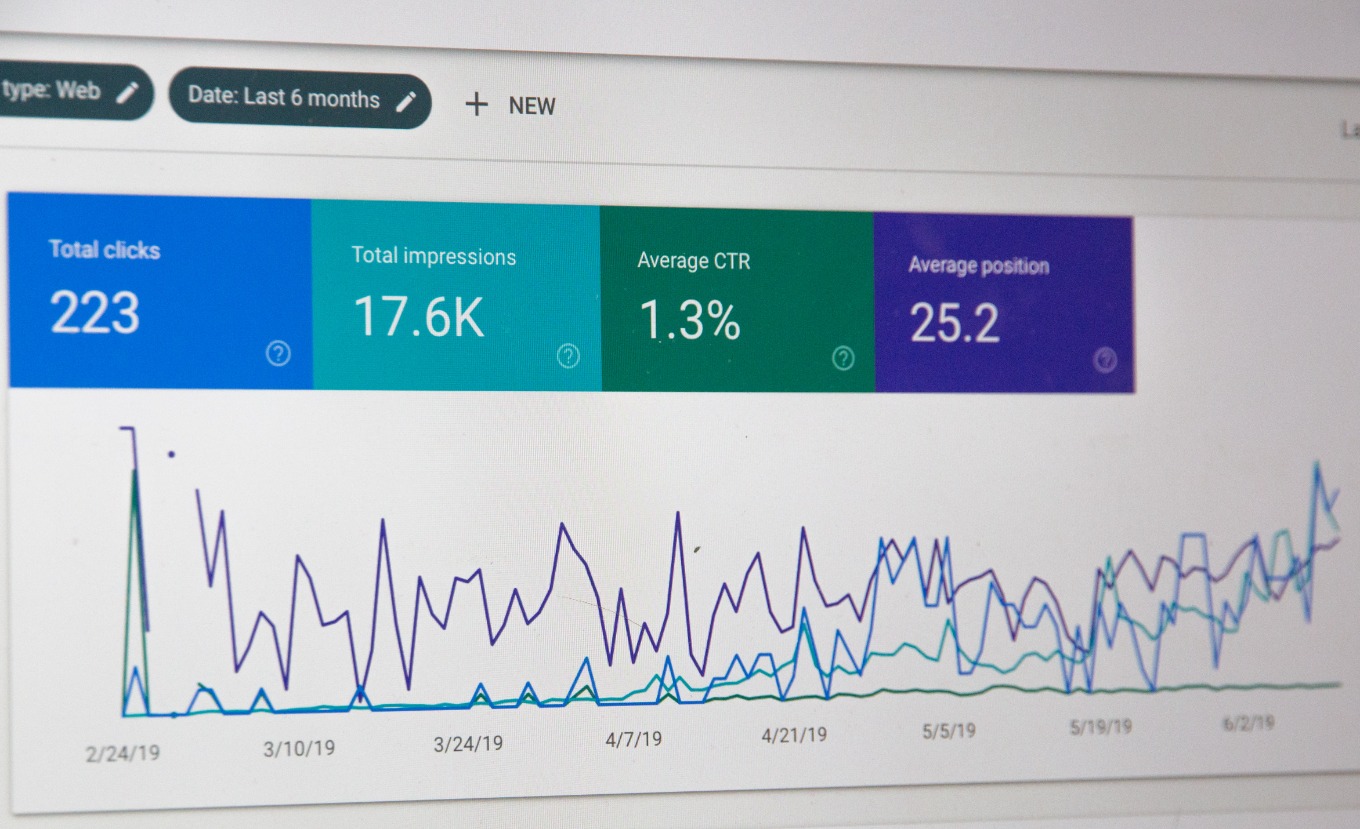

Fact: Many tax software packages incorporate tax planning modules that provide customized tips to help users reduce their tax liabilities in the future. These modules use predictive analytics, a branch of advanced data analytics that uses historical data to predict future outcomes, to provide actionable tax-saving advice.

Fact: Tax software companies are diligent about updating their products to reflect the latest tax laws. They employ teams of tax professionals who monitor legislative changes and ensure that their software stays current. Automatic updates are usually made available to users promptly after any major tax law change.

In conclusion, while personal income tax software may not be the perfect solution for everyone, it is an invaluable tool for many. It is designed keeping in mind the intricacies of the tax system and the varying needs of taxpayers. With this pragmatic understanding, one can set aside myths and make an informed decision about using personal income tax software.

This post aims to debunk ten of the most common myths about personal income tax software and provide comprehensive insight into their functioning, utility, and impact.